Do you have any idea how many clients you lose each year? What about each month? Customer churn, also known- as customer turnover, is the number of clients you lose in a certain period.

Your churn rate can be a frightening statistic, but it's also an extremely significant one to know. Without it, you won't be able to build improvement plans to lower your turnover rate.

The task of calculating and preventing customer churn rate is challenging at first, but don't worry; we'll cover everything you need to know about churn rate in detail in this post, including:

1) What is the Churn Rate?

2) Churn Rate vs Growth Rate

3) Types of Churn

4) How Does Churn Rate Impact SaaS Metrics?

5) How to Calculate Churn Rate?

6) Customer Churn Rate Formula

7) Revenue Churn Rate Formula

8) Annual Churn Rate Formula

9) Churn Rate Examples

10) What is a Good Churn Rate?

11) Practical Strategies to Reduce Churn Rate

12) Conclusion

What is the Churn Rate?

The churn rate measures how many customers stop doing business with a company in a given period. It's most commonly expressed as the percentage of customers who discontinue their subscriptions within the given period - so if you want your clientele base to grow, you need to ensure that you're getting more new clients than those you lose!

Churn Rate Vs Growth Rate

A company's churn rate and growth rate can be calculated by comparing new customers to lost subscribers over a given time period to see if there was overall growth or loss. The churn rate is used to track lost clients, whereas the growth rate is used to track new consumers.

The business grows if the growth rate is larger than the churn rate. Conversely, when the churn rate is larger than the pace of growth, the company's client base shrinks.

For example, if a corporation gained 90 new subscribers in one quarter but lost 110, the net loss would be 20. This is because the corporation did not increase this quarter but lost money.

A company needs to ascertain that its growth rate exceeds its churn rate; otherwise, revenues and earnings will decline, and the company will eventually be forced to close.

Types of Churn

1) Voluntary churn- Voluntary churn results from a conscious decision by your customer to cancel their subscription with you. They have found that the subscription is no longer necessary for them, or they've chosen to switch over to another service or even your competitors' products.

2) Involuntary churn- One cause of subscription cancellation can be an expired card. This can lead to the customer's payment attempt failing and result in them being unable to pay for their product or service at that moment. This is known as involuntary churn when their subscription is canceled as a result of this.

Reasons for Involuntary Churn:

1.) An expired payment card

2.) Hard declines that occur when a card is reported lost or stolen

3.) Soft declines that happen when a credit card has maxed out its limit

4.) Banks can also decline the card due to suspected fraudulent activity or frozen accounts

Causes for involuntary churn:

1) Poor onboarding

2) Customer service that's not up to scratch

3)Attracting the wrong customers

How Does Churn Rate Impact SaaS Metrics?

Your churn rate directly reflects the product's value and features you're delivering to customers. With Billsby's exit reasons report, you can learn why your customers are churning.

In addition, Billsby allows SaaS enterprises to view different churn reasons and the income impact over time, giving your team real-time insight into how to improve retention.

To lower the customer churn rate, your organization should constantly optimize your service. Furthermore, customer churn has a direct impact on the company's financial metrics, such as Monthly recurring revenue(MRR), Lifetime Value(LTV), and customer acquisition cost(CAC).

How to Calculate Customer Churn Rate?

To measure the percentage of churned revenue, first, take the monthly recurring revenue (MRR) at the start of the month and divide it by the MRR lost from customers leaving within the month — subtracting any upgrades or additional income from existing customers.

You don't need to count any new sales in the month since you're trying to figure out how much total revenue you lost.

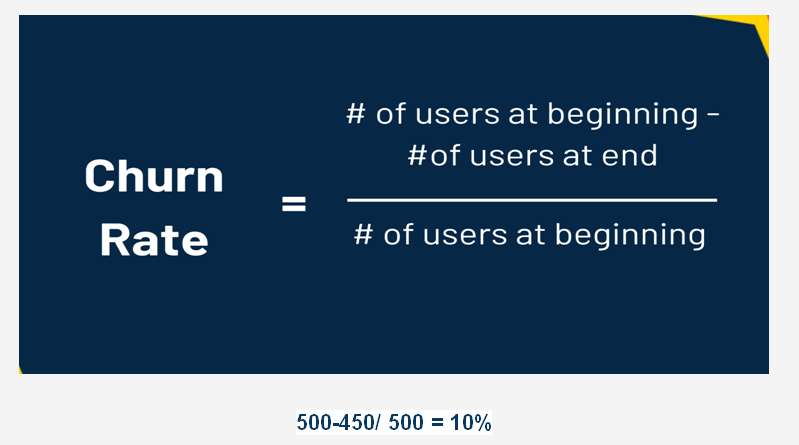

For example, if Company ADG had 500 customers at the beginning of the month and only 450 customers at the end of the month, its customer churn rate would be 10%.

Customer Churn Rate Formula-

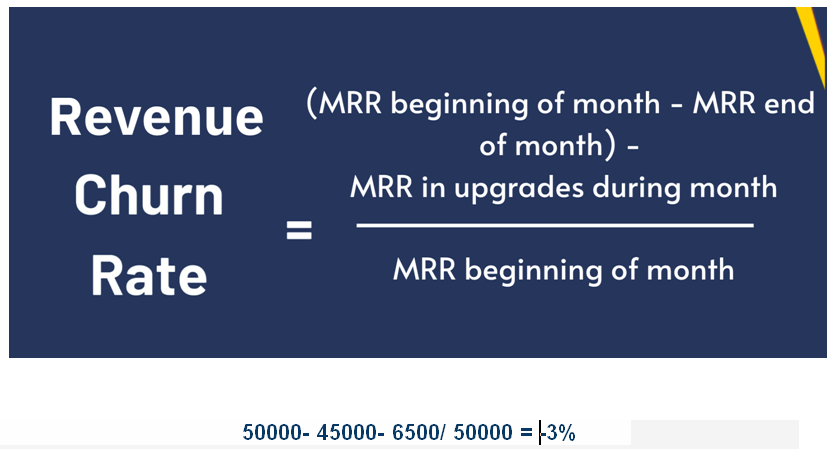

Revenue churn rate formula

To measure the percentage of churned revenue, first, take the monthly recurring revenue (MRR)at the start of that month and subtract MRR at the end of that month (minus all the upgrades during the month) and divide it by the MRR from the start of the month again.

You don't need to count any new sales in the month since you're trying to figure out how much total revenue you lost. You have gained revenue by generating new revenue from existing clients.

For example, if Company X had $50,000 MRR at the beginning of the month, $45,000 MRR at the end of the month, and $6500 MRR in upgrades from existing customers, its revenue churn rate would be -3%.

Annual churn rate formula

In the case of an annual plan, you can use the same formula(s) as above but just look at the figures over the year rather than a single month. Again, this logic applies to any given period you need to work out your churn rate for.

Churn rate examples

Many SaaS companies, particularly those in the B2C industry, make their churn rates public in order to demonstrate how successful they are at retaining clients.

You can use these examples to help you understand your personal churn rate, what it should look like for your company, and where other well-known organizations fall on the spectrum.

1) Spotify Churn Rate- Spotify is a prominent music streaming service with an extensive song library and tailored recommendations. It has a 4.8 percent reported churn rate.

2) Disney Plus Churn Rate- Disney has long resisted partnering with rival streaming services, opting to develop its own platform for distributing its content online. Users flocked to Disney+ when it launched in 2019, and very few have left. It's no wonder, then, that Disney+ has a low monthly churn rate of 4.3 percent.

3) Netflix Churn Rate- In the video streaming sector, Netflix boasts one of the lowest churn rates. It has a low monthly churn rate of 2.5 percent, which means that over 97 percent of subscribers opt to stay with Netflix. Its extensive collection of shows and well-established brand voice could be one of the reasons.

What is a Good Churn Rate?

A SaaS company's typical monthly churn rate is 2-8 percent, and the average annual churn rate is 32-50 percent. The lower the number, the better; otherwise, it will substantially influence your Monthly Recurring Revenue (MRR). The churn rate for B2B SaaS enterprises with high average contract values (more than $1,000 per month) should be less than 2%.

A churn rate of 0 would be ideal, as it would suggest that a company is not losing any users; however, this is rarely the case. For one reason or another, a firm will inevitably lose subscribers.

In this scenario, it's crucial to compare the company's churn rate to the industry's typical churn rate while considering whether the company is new or established. The only way to determine whether a churn rate is appropriate or unsatisfactory is to compare it to the industry average. Every industry has a unique business model, meaning acceptable churn rates will vary.

If you don't want declining revenue, making your product the best it can be is essential. You can do this by:

1) Ask for feedback from your clients regularly. Especially if your product is subject to change

2) After a month of use, survey them to see how they feel, and then follow up with another survey after a few months to see whether the reaction is either still favorable or better than before.

3) If you measure a high churn rate for a specific period in the customer journey, for example, if you notice a lot of churn in month 2, you'll want to find out why. Use feedback surveys and direct contact with customers to determine what's wrong and how to solve it.

4) Always be innovative. You could have excellent retention and churn rate, but all it takes is for a competitor to disrupt the market, and everyone suddenly leaves.

Effective Strategies to Reduce Churn Rate

1) Focus on customer engagement

2) Establish an excellent onboarding experience

3) Adopt a pro-active approach

4) Focus on high-value customers

5) Strengthen customer support

6) Improve consistency

7) Acknowledge complaints and feedback

8) Nail the subscription analysis

9) Provide annual contracts to lock customers into subscriptions

10) Create a smart dunning workflow to reduce involuntary churn

You can read this blog for a more detailed explanation of the above suggestions for reducing churn.

Conclusion

Retaining and developing your customer base as a SaaS firm means evaluating your performance at each step. Calculate your customer attrition rate over the course of a year or a month, then improve your customer service processes and invest in your customer service personnel to see your churn rate drop dramatically.

A product like Billsby can be a game-changer in ensuring you always have a hold on your company's critical KPIs.