What is the ACH Network?

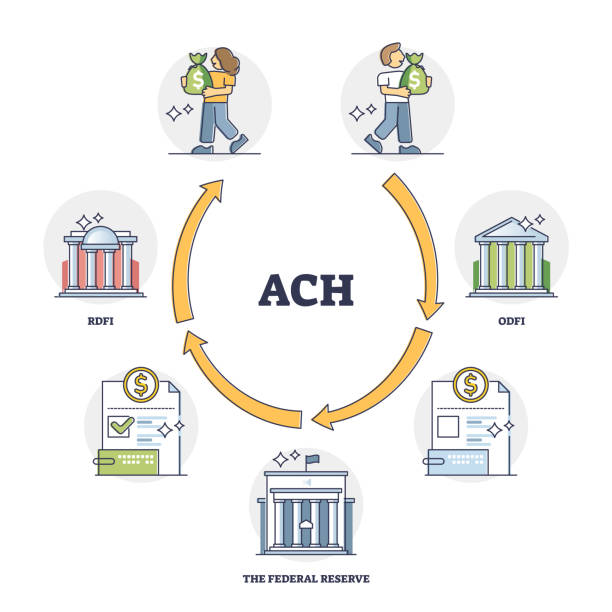

The ACH Network is operated by Nacha - an organization that creates mandatory rules for a safe and effective ACH payments system.

What are ACH payments?

An ACH payment is a kind of electronic transaction from one bank to another. ACH payments are an alternative to cash, paper cheques, wire transfers or card networks for transferring money between bank accounts. ACH payments are also commonly known as ACH transfers or transactions.

The network is US-based covering the U.S. Virgin Islands, Guam and the Northern Mariana Islands, with international transfers also being possible. ACH payments, however, are not generally made outside the United States, primarily due to speed.

ACH Categories and how they work?

The two main categories of ACH transactions are direct deposits and direct payments:

A.)Direct deposit

Direct deposits are how 96% of American workers get paid. It's fast and reliable and puts the consumer in control of their finances. Consumers can access their money promptly with no additional fees to receive their pay. Apart from payroll, direct deposits include payments of the following -

1.)Employer

2.)Reimbursed expenses

3.)Government benefits

4.)Tax refunds

5.)Interest payments

6.)Annuity payments

B.)Direct payment

For instance, direct ACH payments online can be used to send money to family, pay bills, purchase a product or service, or support a not-for-profit organization. In an ACH immediate payment, the one who sends money sees an ACH debit in their bank account while the person/ entity receiving the money receives it as an ACH credit.

Types of ACH Payments

Within the Direct Payment Category, ACH transfers have two distinctive are processes, ACH Credit and ACH Debit.

1.)ACH Credit transactions

These involve 'pushing' funds into an account. This means that the customer initiates the transfer of funds to the business. So, for example, the payer will 'push' the funds from their bank account to yours.

2.)ACH Debit transactions These involve 'pulling' funds out from an account. This means that a business can automatically collect payments directly from their customer's account with the customer's authorization.

How are ACH payments processed?

On the other hand, ACH debit transactions must be processed by the next business day. After receiving the money, a bank or credit union may also need to hold onto these transferred funds for a short period, leading to the total delivery time varying.

How much does it cost to process ACH payments?

The average internal cost for processing ACH payments is $0.29 per transaction. However, the total cost of accepting ACH payments varies based on numerous factors.

There are two accessible routes for businesses that would like to utilize recurring ACH payments - direct and through a third-party processor. Both routes have their strengths and weaknesses. Obtaining direct access can be expensive and time consuming to build but gives companies more flexibility and more detailed information with regards to the payment.

This is usually to most suitable for large businesses within house development and legal teams to deal with the building the payment system and the regulatory requirements associated with ACH payments.

On the other hand, going through a payment processor (such as Stripe) drastically reduces the time required to access the scheme, simplifies ongoing costs, automatically keeps companies up to date with the regulatory requirements and offers a ready to use payment system.

How to accept ACH payments?

You can use a payments processor or a bank that helps to run and set up ACH payments.

1.) To use a bank, all you must do is set up a business bank account and give your customers your banking details.

After that, customers can initiate the payment on their end, and you require no further action. Using this method will need you to keep up to date on the regulatory requirements associated with ACH payments, and make sure you fulfil them.

2.)On the other hand, if you prefer the third-party payment processor, you might end up paying less and accepting ACH payments more efficiently.

Why are some ACH payments rejected?

If an ACH payment gets rejected, the bank should provide you with a reject code explaining where the error occurred.

These reject codes are essential for offering the correct information to your customers as to why their payment didn't complete. Below are the some of the most common reject codes:

1.)R01 insufficient funds

2.)R02 bank account closed

3.)R03no bank account/unable to locate the account

4.)R29 reject (don't allow to withdraw funds)

Benefits of ACH payments

There are multiple reasons why ACH payments are becoming payment option for businesses:

1.) Lower processing costs

ACH transactions typically have the lowest processing fees as the money is processed directly from one bank account to the other. This will usually cost your business less than processing credit cards.

2.)Provides entire control

ACH debit is a pull payment which gives you control over the transfer date, amount and frequency. Having control of your payment income ensures you have better cash flow in your business.

This enhanced cash flow can also enable you to attempt realistic and efficient business planning as well as reduce the stress of late payments.

3.) Fewer declines, higher customer retention

Bank accounts do not become lost or expire like credit or debit cards, so you’ll deal with less payment declines when you process ACH payments online.

4.)No late payments

ACH debit reduces failed and late payments freeing up time and space for businesses to focus on other essential tasks.

5.)Automatic ACH payments save time and money

Through an ACH Debit's structured automated payment collection and an existing accounting software integration, businesses can preserve even more time on financial aspects such as bank reconciliation.

Customers don't have to search for their cheque books every month; instead, they can just "set it and forget it" by subscribing to recurring billing using ACH as the payment method.

6.)More accessible to start accepting ACH payments - In a few clicks, you can create a mandate and send ACH payments link to your customer. Your customer can then complete the online form and you can collect payments as required.

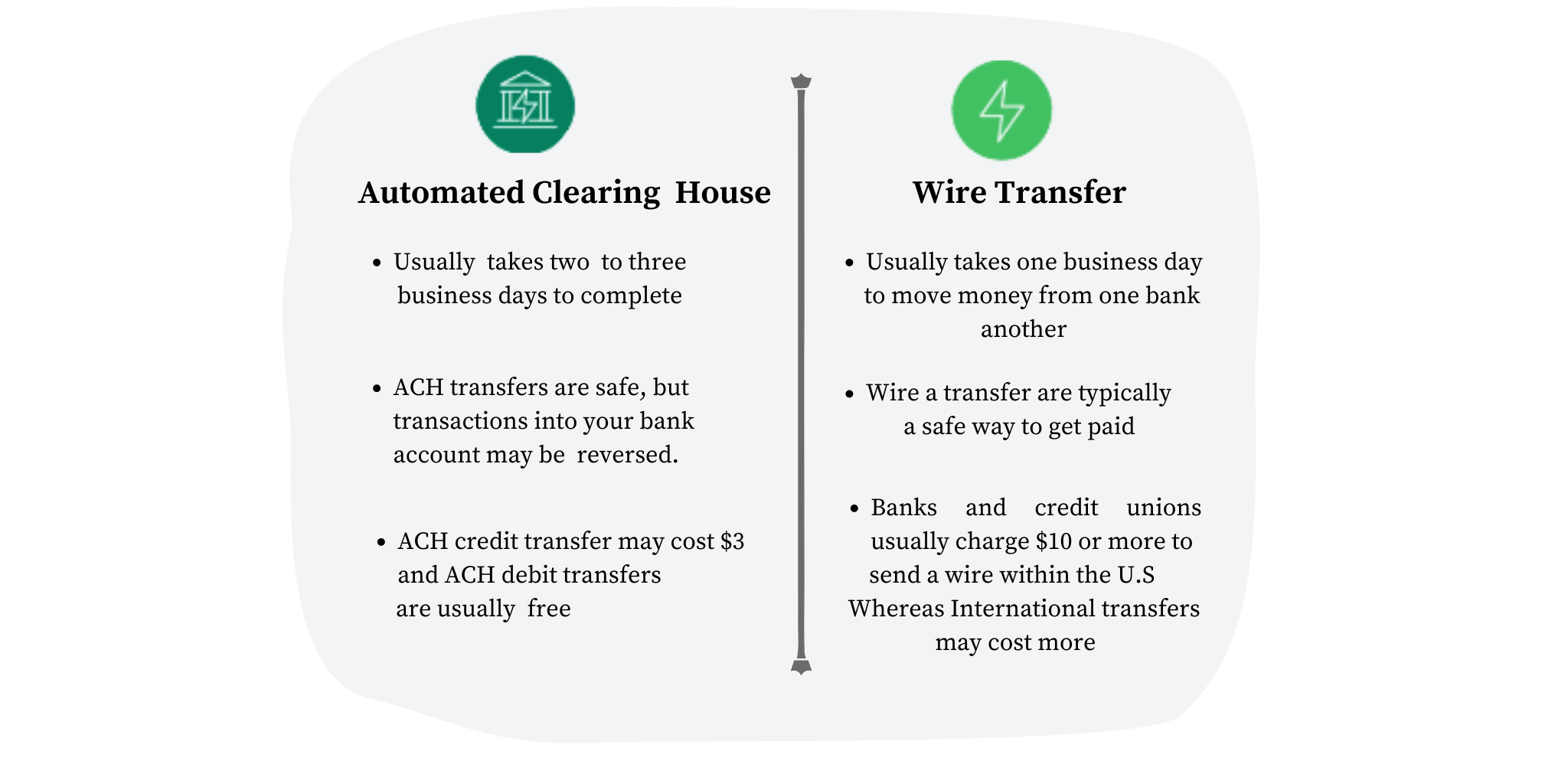

ACH Payments Vs Wire Transfer

Wire transfers are processed in real-time, conflicting with ACH payments processed in batches at specific times during the day. Consequently, wire transfers are assured to arrive the same day, while ACH funds can take additional time to be processed. This being said, wire transfers can be relatively expensive as compared to ACH payments.

Drawbacks of ACH payments

ACH payments for businesses are convenient but not necessarily perfect. There are some drawbacks to keep in mind when using them to transfer money or pay bills:

1.)Transaction limits Banks can limit how much money you can send through an ACH transfer. These can be per transaction, weekly, monthly, or even daily limits.

There might be different limits on different transfers, for instance – one limit on bill payments and another on bank transfers, or even different limits for different businesses and their customers.

2.)Processing time The time frame matters for ACH payments because not every bank processes them simultaneously. It can typically take two to five business days to process.

3.)Transferring from a savings account could trigger a penalty - With ACH, if you transfer multiple times from a savings account to another bank account, you could be hit with an excess withdrawal penalty. In addition, if this continues on a regular basis, there is a possibility that the bank might convert your savings account into a checking account.

4.)International barrier It’s likely that your bank will not allow ACH payments to and from international bank accounts.

Other ways to send money online

If you need to find a faster way of sending money online, a social payment money transfer app can be of great use. These apps enable you to transfer money to people using their email addresses or phone numbers. The transfer you make can be from your bank account, credit card or an in-app balance. Apart from being easy to use, the main benefit of using these apps is their transfer speed.

Other ACH integrations

1.)Chase ACH payments Chase offers an Automated Clearing House payment service. It is a secure, quick, and convenient way to pay your vendors or employees through Direct Deposit.

2.)Plaid ACH payments Plaid focuses on offering accessible financial services through technology. It possesses a friendly interface and effective tools that allow everyone to create impressive products.

3.)Bill.com ACH payments Bill.com is a safe, speedy, and cost-effective way to process ACH payments for your businesses.

4.) Wave ACH payments - Wave offers fair pricing with no monthly fees or surcharges and returns the processing fee with refunds. It provides faster payouts and is quick and easy to use.

5.)QuickBooks ACH payments/Intuit ACH payments Quick books helps to reconcile your books for every ACH payment you accept automatically.

6.)Chime ACH payments This is a full-featured deposit account that supports pre-authorized withdrawals through ACH Network.

7.)PayPal ACH Payments Provides services that enable businesses to originate ACH credit and debit entries to a bank account.

8.)Verizon ACH payments It can take ACH payments and some guidelines to correctly apply for the payments.

9.) Xero ACH payments

10.)woo commerce ACH payments

Conclusion

ACH payments can be reasonably hassle-free to send or receive money. In either of the two ways, make sure you thoroughly understand your bank's policies for ACH direct deposits and direct payments. Also, always be vigilant for any ACH transfer scams.

ACH: Points at a glance

1.)ACH refers to Automated Clearing House, operated by Nacha

2.)ACH payments are a kind of electronic bank-to-bank payment available only in the United States and its associated territories

3.)Payments via the ACH network are cheaper and possess a higher success rate than alternative methods such as card payments.

4.)ACH Debit payments are available for many American consumers and scale customer retention.

5.)It's effortless to set up ACH Debit with Billsby and is worth considering for any business using recurring payments.

6.)There are many practical benefits of using ACH Payments

FAQS

A.How do I set up ACH payments?

Steps to set up ACH payments:

1.)Setup your account

2.)Select an ACH payment processor

3.) Fill out the following paperwork

4.) Understand the various types of ACH payments

5.) Choose the suitable entry class

6.) Read the ACH payment terms and conditions

B.)What banks accept ACH payments?

Here's a list of some banks that accept ACH payments:

1.)Bank of America

2.)BB&T

3.)BMO

4.)Harris

5.)Capital One

6.)Chase

7.)Citibank

8.)HSBC bank

9.)Key bank

10.)PNC bank

11.)SunTrust

12.)Union Bank

13.)U.S. Bank

14.)Wells Fargo

3.)Are ACH payments free?

ACH debit transfers involving direct payroll deposits and most online bill payments are generally free. However, if you require expedited bill payments, there might be fees.

4.)How long do ACH payments take?

ACH payments processing conventionally take three working days to appear in your bank account. According to NACHA, almost all ACH payments are eligible for same-day processing, although you might have to pay a premium.

5.)How to receive ACH payments?

The easiest way to receive ACH payments is through a bank. All you have to do is open a business bank account if you already don't have one and then provide the customer with your banking details.

6.)What is the cutoff time for ACH payments?

Nacha provide 3 distinct processing windows for users for request of same-day ACH payments :

1.)First deadline- 10:30 a.m. ET (settled at 1:00 p.m. ET)

2.)Second deadline- 2:45 p.m. ET (settled at 5:00 p.m. ET)

3.)Third deadline- 4:45 p.m. ET (settled at 6:00 p.m. ET)